Overview

The electronic payment solutions shall be seamless with the fast goings of life in this digitized world of today. A business is not idle and therefore continuously seeks some innovations that give the fastest possible transaction, extremely safer transaction, and perhaps efficient transaction between buyers and sellers or their agents for these transactions.

It is here that the provisioning service of the Visa comes up connecting the virtual with the actual or physical in that it presents users with smarter, connected, payments.

This comprehensive Article explains what Visa Provisioning Service is, how it operates, its advantages, and how both consumers and companies can use it.

What is a Visa Provisioning Service?

Visa’s digital payment solution, Visa Provisioning Service, facilitates the process of entering payment credentials into devices. To put it briefly, the service lets users and companies safely add, maintain, or update payment information on digital platforms and linked devices, such as smartphones, smartwatches, and Internet of Things gadgets.

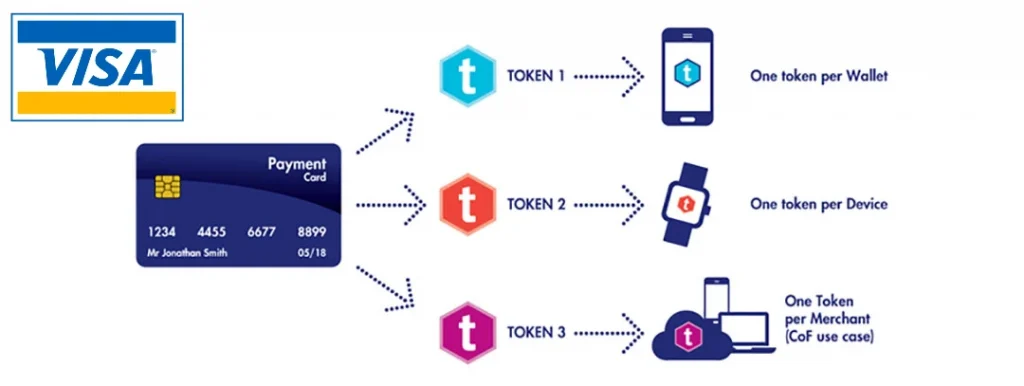

This service would be quite significant in the light of tokenization, a technology that simply replaces sensitive card information with just a unique token, enabling someone to complete certain transactions without an exposure of the genuine card details against significant security enhancement.

How Does the Visa Provisioning Service Work?

Visa Provisioning Service works on a very simple process, which is at the same time highly secure. Here is an overview of the working:

- Device Identification: the service identifies whether the user accesses from a mobile phone, wearable or an IoT.

- Token Request: Payment information is tokenized and a request for token is sent to the Visa network.

- Token Issuance: Visa generates a unique token and sends it to the user’s device.

- Secure Storage: The token is stored securely on the device or within a secure digital wallet.

- Transaction Completion: Sensitive card information is kept private when a user begins a payment since the token is utilized to complete the transaction.

The user has a frictionless experience because the entire process is smooth and takes place in the background.

Key Features of Visa Provisioning Service

Visa Provisioning Service has several features that make it an invaluable tool for businesses and consumers. These include:

- Tokenization: uses a token throughout transactions to protect sensitive card information.

- Compatibility with all kinds of devices: compatible with a wide range of wearables, IoT devices, and smartphones.

- Global Reach: As a Visa service, it offers comprehensive worldwide network assurance that aligns its offerings with numerous locations.

- Enhanced Security: removes the need to provide actual card information, lowering the danger of fraud and data breaches.

- Real time updates: To ensure that the user device has the most recent information, the app is permitted to update payment credentials in real time.

Advantages of Visa Provisioning Service

1. Enhanced Security

The potential of Visa Provisioning Service to improve security is one of its main benefits. The solution lowers the risk of fraud and data breaches by tokenizing payment information, guaranteeing that private card information is never revealed. In a time when cyber risks are increasing, this is particularly important.

2. Seamless User Experience

The service simplifies the process of adding payment credentials to devices. Users can quickly and easily add their payment information without the need for complex procedures, resulting in a seamless experience.

3. Global Compatibility

Visa’s extensive network ensures that the provisioning service is compatible with merchants and payment systems worldwide. This makes it an ideal solution for travelers and businesses operating in multiple regions.

4. Support for Emerging Technologies

The Visa Provisioning Service is made to function with cutting-edge technologies including wearable technology and Internet of Things devices. This guarantees that companies and customers may take advantage of the most recent advancements in payment technology.

5. Cost Efficiency for Businesses

The solution reduces the costs that companies face when utilizing traditional methods for processing payments. It also lessens the likelihood of chargebacks and fraud-related losses, which saves a significant amount of money.

Use Cases of Visa Provisioning Service

Visa Provisioning Service has a wide range of applications, making it a versatile solution for various industries. Some of the most common use cases include:

- Digital Wallets: Examples of digital wallets include Google Pay, Apple Pay, and Samsung Pay. They use Visa Provisioning Service to store and manage the users’ payment credentials in a secure way. This enables the user to make payments with the help of the smartphone or even his smartwatch.

- Subscription Services: The service provider can be used for the subscription-based service agencies, such as streaming services, SaaS-based companies, as a secure source of regular income.

- Retail and E-commerce: The Visa Provisioning Service can be used by retailers and online portals in framing a more stable, convenient bill-paying alternative for the clients thus also enhancing the shopping experience and thereby consumer satisfaction.

- Connected Devices: IoT-connected devices are multiplying-for example, one thinks of an intelligent refrigerator and other voice-activated assistants-applying Visa Provisioning Service for ease and secure payments. Imagine a scenario wherein, automatically, it detects that there are low groceries in it and just auto-orders groceries when its supplies have worn out.

- Transportation: The same service is applied in the transportation systems, and through smartphones or electronic wearables, users can pay for tickets and other fares in contactless payment.

How to Implement Visa Provisioning Service

Visa Provisioning Service implementation would require the participation of businesses, financial institutions, and Visa. The following steps are involved in this process:

- Partner with Visa: Businesses need to establish a partnership with Visa and gain access to the provisioning service.

- API integration: Visa provides the APIs, which are to be integrated into the system of a business, to enable the provisioning service.

- Tokenization Setup: Incorporation of tokenization technology to ensure payment credentials are managed securely.

- Test and Deploy: Thorough testing should be conducted to ensure that the service works smoothly before being deployed to the customers.

- Monitor and Optimize: Monitor the service and optimize it continuously with regard to feedback from users and emerging trends.

Challenges and Considerations

Despite so many advantages being provided by the Visa Provisioning Service, one has to make note of quite a few considerations and challenges along the way :

- Integration Complexity: A substantial amount of technical know-how and resources may be needed to implement the service.

- Strict compliance: criteria must be followed by businesses in order to protect user data’s security and privacy.

- Device Compatibility: It can be difficult to guarantee compatibility with a large variety of devices.

The Future of Visa Provisioning Service

With the increased evolution of digital payments, Visa Provisioning Service is about to shape what the future of transactions will look like. Adoption of IoT devices, wearable technology, and digital wallets will see the demand for security and efficiency in payment solutions rise.

Moreover, with improvements in Artificial Intelligence and machine learning, the ability to include even more personalized or predictive capabilities for even better payment experiences can be added.

Conclusion

The Visa Provisioning Service is one huge leap in the field of payment technology, housing enhanced security, convenience, and global compatibility. Be it a business willing to smoothen the processes of making payments or a consumer in search of seamless payment experiences, this service houses a lot for one and all.